This type of bookkeeping involves recording revenue and expenses when they’re earned, even if a payment hasn’t yet been made or received. As a bonus, your company’s income isn’t taxable until it’s in the bank because your business transactions aren’t recorded until you’ve received or made a payment. There is money in the bank, or it’s not, which means you’ll always know how much money you can access.

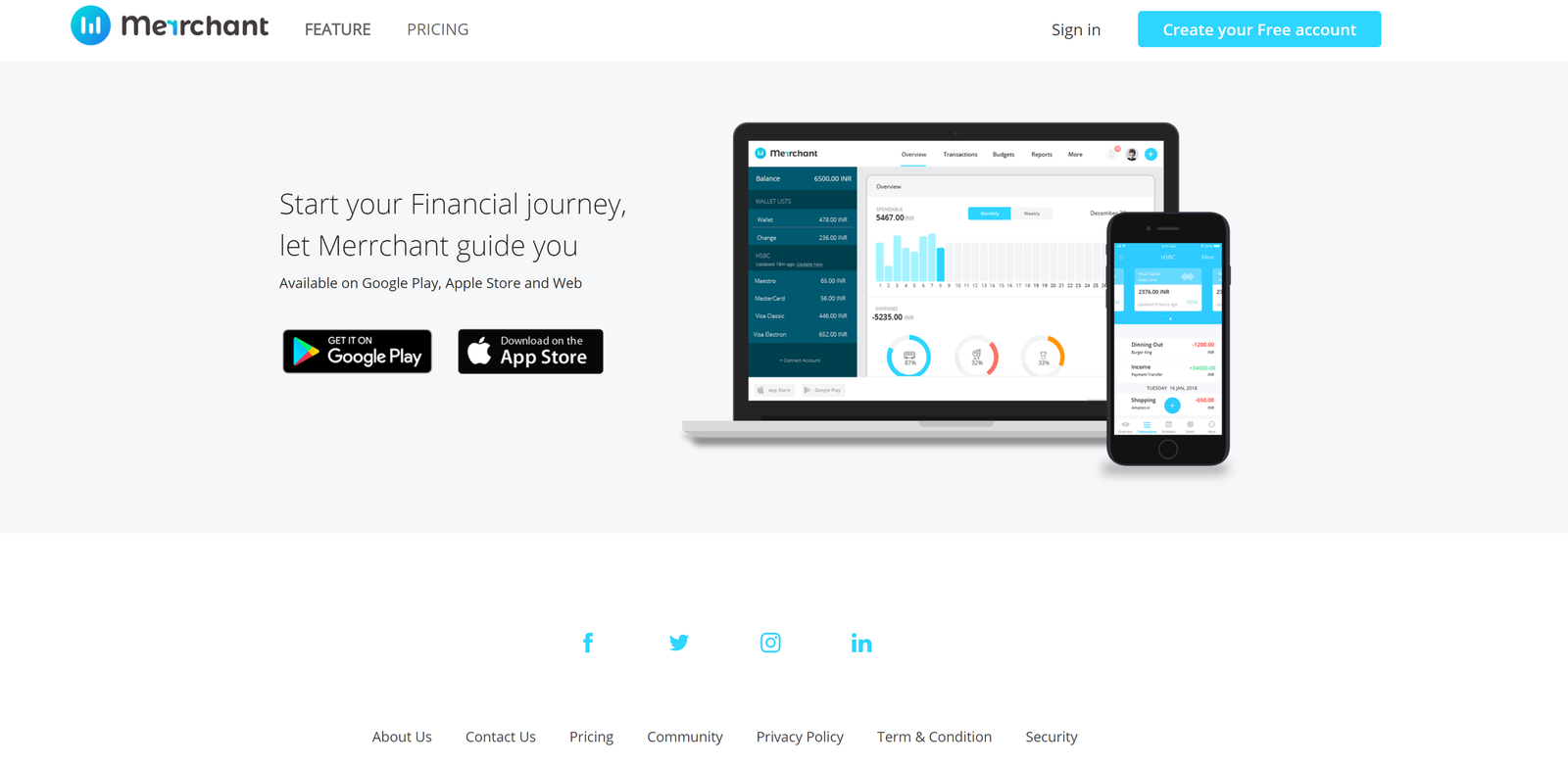

The cash method is easy for DIY-ers because you can quickly tell when a transaction has occurred. It doesn’t take into consideration accounts receivable or payable. This methodology recognizes revenues only when cash is received and recognizes expenses only when expenses are paid. It will fall into one of two general categories: If you can hire a part-time bookkeeper, talk to them about what they’ve used for similar clients and allow them to help you select the best option for your business. Get a good bookkeeping programĮxplore the types of bookkeeping options available to you, which range from handwritten ledgers to Excel spreadsheets to automated systems, and choose the right solution for the way you work. Whether you choose to hire part-time or just DIY, here are seven tips to keep things running smoothly: 1.

#Bookkeeping programs how to#

How to handle bookkeeping efficiently at your business Hiring a bookkeeper part-time can range from $15 to $60 an hour, depending on location, workload and other factors. Initially, many small businesses opt to do it themselves or hire a bookkeeper part-time.Īccording to, until a company’s revenue rises well above the $1 million mark (or 30+ employees), most businesses don’t have enough work to keep a full-timer busy every day. Because bookkeepers and accountants work in tandem to provide you with a clear picture of your business, having both on staff is important as your operations grow. Moreover, accountants often help business owners with tax strategy and planning, completing tax returns and financial forecasting. What’s the difference between accountants and bookkeepers?Īt this point you may be asking yourself “isn’t that what accountants do?” Well, no.īookkeepers are primarily concerned with the daily transactions of a business and handle more of the financial administration, while accountants take a more “big picture” approach to your financials, offering insights and information based on what bookkeepers do. All of this can help you make more informed decisions about spending, keep your financial books in order for tax season and give you essential data on seasonal trends.

Track mission-critical KPIs, like growth, cash flow, revenue growth and profit margin.That includes handling customer receipts, invoices, payments to suppliers, client billing, payroll, tracking and maintaining budgets, recording depreciation and reporting issues as they arise. The short answer is that a bookkeeper tracks and records all of a business’ day-to-day financial transactions. So, what exactly does a bookkeeper do? Let’s take a look.

#Bookkeeping programs software#

But it’s so much more than writing down numbers in a ledger or a software program and tracking money in and out. From better budgeting and tax preparation, to planning and peace of mind, good bookkeeping equals good business. While the days of dusty ledgers and paper receipts are becoming a thing of the past, bookkeeping is here to stay.

0 kommentar(er)

0 kommentar(er)